Early Rollout of Fiscal Policy Could Reduce Emissions in the Middle East & Central Asia

The IMF says the region must reduce per capita emissions by 7% over the next eight years

November 9, 2022

The Middle East and Central Asian countries have collectively pledged to reduce annual greenhouse gas emissions (GHG) in 2030 by 13-21%, a new IMF study estimates. On assessing the region’s commitments to reduce GHG emissions, the agency identifies fiscal policy as its best option to realize this goal.

As part of the Paris Agreement, 32 Middle Eastern and Central Asian countries pledged to contain their GHG emissions. To meet these commitments, governments must integrate climate policies into national economic strategies and reduce their per capita emissions by about 7% over the next eight years. The study finds only a few countries have achieved the promised reduction levels while maintaining stable economic growth.

The agency primarily outlines two categories of fiscal policies to curb GHG emissions in these regions:

- Measures that raise the effective price of fossil fuels

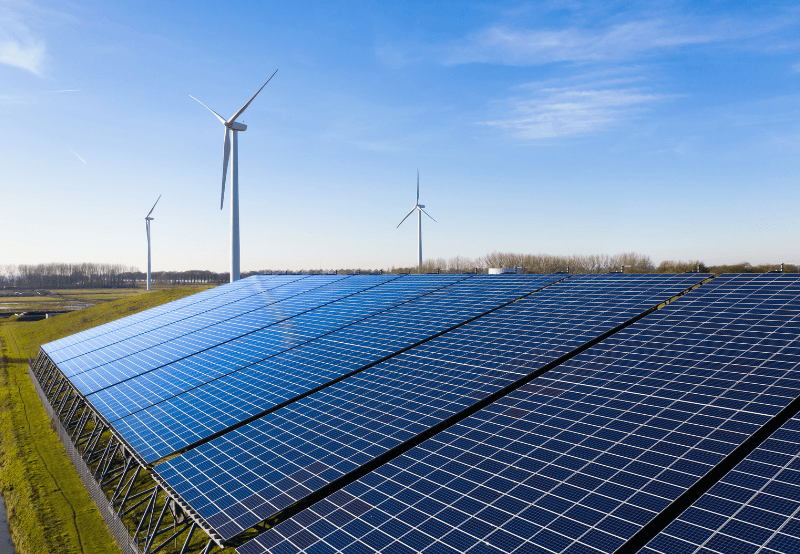

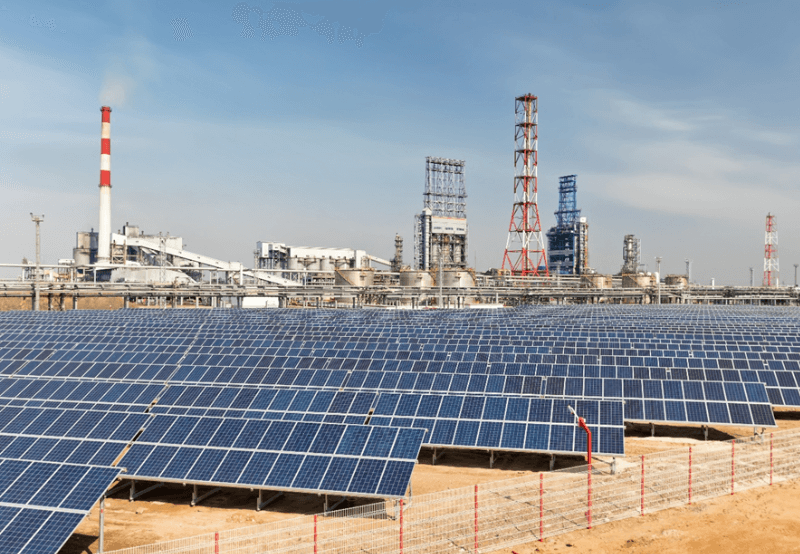

- Public investments in renewable energy

Ways to Achieve the Target

A gradual removal of fuel subsidies in addition to a phased introduction of a carbon tax of $8 per ton of CO2 emissions in the Middle East, North Africa, Afghanistan, and Pakistan ( MENAP), and $4 per ton in the Caucasus and Central Asia (CCA), could ensure the region’s 2030 mitigation targets.

Successful instances of this are – Kazakhstan introducing an emissions trading scheme, Jordan phasing out fuel subsidies, and Saudi Arabia recently establishing a regional carbon credit market.

Secondly, IMF finds that public investments in renewable energy of $770 billion in MENAP and $114 billion in CCA — more than a fifth of the region’s current gross domestic product — between 2023 and 2030 could achieve the region’s emission reduction targets with fuel subsidies reduced only by two-thirds and without any carbon tax.

Large-scale renewable projects are already taking off in the region. For instance, Qatar developed an 800 MW capacity to meet about a tenth of the country’s peak demand, while Dubai built a 5 GW single-site solar park.

Sharing the economic burden

Governments in the region face a difficult decision of how to share the economic burden of climate mitigation across generations.

The agency identified raising the effective price of fossil fuels has near-term challenges because it calls on the current generation to bear the burden of the energy transition. While in the long term, such a transition can lead to a cleaner and more energy-efficient economy, in the short term, it could result in a temporary slowdown of economic growth and increased inflation.

Next, while targeted investments in renewable energy sources will create more jobs and faster growth while improving the energy security of oil-importing countries, this approach also has some long-term costs.

Fuel subsidies will likely distort energy prices, limiting energy efficiency gains and leaving emissions in many parts of the economy largely unabated. Additionally, significant public spending to accelerate the energy transition could weaken fiscal positions and macroeconomic stability, leaving fewer resources available to future generations.

IMF estimates under such conditions, the net government debt in 2030 could rise by 12% of GDP in MENAP and 15% in the CCA, leading future generations on a path of slow long-term growth.

Under present conditions, the agency suggests countries choose an option that best suits their circumstances and the available budget resources. Regardless of choice, early adoption of a fiscal strategy will be key in meeting mitigation pledges on time and minimizing potential economic disruptions.

In July, a new report by Global Energy Monitor revealed that the MENA region planned over 73 GW of new utility-scale solar and wind power projects, a five-fold increase in current capacity that will account for 91% of the Arab’s League 2030 renewable energy target of 80 GW.

Recently, Saudi Aramco, a global energy and chemicals company, established a $1.5 billion sustainability fund to invest in technology to support a stable and inclusive energy transition that will help to address climate change.

Get the most relevant India solar and clean energy news.

RECENT POSTS

Nov 30, 2022

Nov 30, 2022

Mar 2, 2023

Mar 2, 2023

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open ...

March 16, 2023

Markets & Policy

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of PowerThe Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity. Stakehold...

November 9, 2022

Mercom Research Focus

India’s Solar Market Leaders for 1H 2022Mercom India has released its report, India Solar Market Leaderboard 1H 2022, unveiling solar market leaders in the first half (1H) of the calendar year (CY) 2022. The report covers market share and shipment rankings across the In...

November 9, 2022

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ PerformanceBattery energy storage technologies globally are transforming how companies utilize, control, and dispatch electricity and facilitating a smoother transition to clean energy. The Indian market is also realizing how battery storage...

November 9, 2022

Trending News

November 30, 2022

November 30, 2022

March 2, 2023

March 2, 2023

November 28, 2022

Tender & Auctions

PTC India’s EoI to Procure 1 GW of Hybrid Power Receives Overwhelming Response

November 3, 2022

Magazine

Grid

GreenCell Raises $40 Million Funding from ADB to Develop Electric Buses

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ Performance

November 7, 2022

Latest News

This is custom content that will be displayed at the video in case you want to give an overview, etc. Michael Ballard

November 30, 2022

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open...

March 16, 2023

The Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity....

November 9, 2022

Some test content that can be displayed somewhere maybe if needed? Not sure Michael Ballard

November 30, 2022

March 2, 2023

OUR FLAGSHIP EVENT, MERCOM INDIA RENEWABLES SUMMIT, APRIL 2023 Mercom India Renewables Summit 2023 (formerly Mercom India Solar Summit) brings together developers, manufacturers, investors, innovators, and other key decision...

November 28, 2022

PTC India’s expression of interest (EoI) to procure 500 MW of hybrid renewable energy (wind and solar) (Tranche-I), with a greenshoe option for an additional 500 MW, has received a strong response, according to Mercom sources....

November 9, 2022

Ballard Power Systems, a fuel cell and clean energy solutions provider, recorded a net loss of $42.88 million in the third quarter (Q3) of 2022, a year-over-year (YoY) increase of 39%. The revenue for the quarter was $21.34...

November 9, 2022

Solid Power, Inc., a U.S.-based developer of all-solid-state battery cells for electric vehicles (EVs), reported a net loss of $12.4 million for the third quarter (Q3) 2022, a 46% increase from the $8.45 million loss during the...

November 9, 2022

Get the most relevant India solar and clean energy news.

POPULAR POSTS

Test Video Post2

Nov 30, 2022

14:46 Installs a Record 2.5 GW of Solar Open Access in 2022, Up 92% YoY

Mar 16, 2023

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of Power

Nov 9, 2022

JANUARY 2023

Nov 30, 2022

DECEMBER 2022

Mar 2, 2023

NOVEMBER 2022

Mar 2, 2023

Mercom India Renewables Summit 2023

Nov 28, 2022