Farm-downs, Partnerships Drive Wind Developer Orsted’s Profit Up in Q3

The company's EBITDA for the quarter stood at DKK12.32 billion

November 8, 2022

Denmark-based wind developer Orsted posted a net profit of DKK9.36 billion (~$1.26 billion) in the third quarter (Q3) of 2022, a massive jump of 1,821% year-over-year (YoY). The company earned DKK10.9 billion (~$1.46 billion) as a farm-down gain from the 50% divestment of the Hornsea 2 and Borkum Riffgrund 3 offshore wind farms.

Through the “farm down” or build-sell-operate model, developers sell stakes in renewable assets to institutional investors keen on long-term and stable yields.

The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) for the quarter stood at DKK12.32 billion (~$1.65 billion), an increase of 313% YoY.

“Despite the highly unusual and volatile period with war, high inflation, and increasing interest rates, Orsted has continued the build-out of renewable energy and the delivery of power and heat to our communities. Most of the power delivered was under fixed-price agreements or hedged,” said Mads Nipper, Group President and CEO of Orsted.

The net profit for the first nine months (9M) of 2022 stood at DKK15.32 billion (~$2.06 billion), a hike of 101% YoY. The EBITDA for the period was DKK25.36 billion (~$3.41 billion), a jump of 58%.

The company posted revenue of DKK96.6 billion (~$13 billion) for 9M 2022, an increase of 105% YoY.

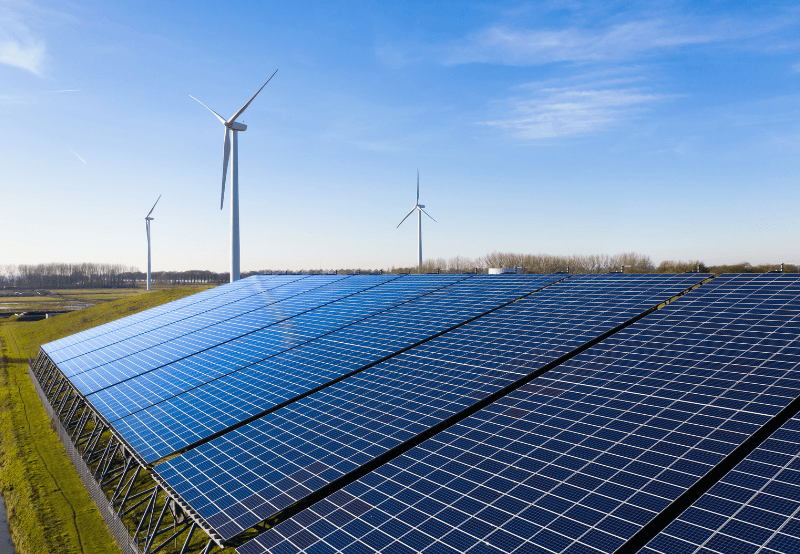

Orsted installed 15,019 MW of offshore wind capacity in 9M 2022. The company also installed 4,160 MW of onshore wind and 661 MW of solar.

Orsted reached several milestones in the build-out of renewable energy during the quarter, including the acquisition of Ostwind, which expands the company’s European onshore portfolio into Germany and France with more than 1.5 GW of development pipeline projects.

Orsted had entered into an agreement to acquire 100% of Ostwind, onshore wind and solar developer, owner, and operator. The deal is based on an enterprise valuation of Ostwind of €689 million (~$705 million). The acquisition is part of Orsted’s strategy to expand its European footprint, which is key to its offshore business.

The company also partnered with Copenhagen Infrastructure Partners to develop 5.2 GW of offshore wind in Denmark.

In June, Orsted secured Є1,350 million (~$1,445 million) through the issuance of green senior bonds to finance its global build-out of renewable energy and green growth ambition of reaching 50 GW of installed capacity by 2030.

Last December, Johnson & Johnson signed two power purchase agreements with Orsted to procure power from its Sparta Solar in Texas in the United States and two wind farms in Ireland.

Get the most relevant India solar and clean energy news.

RECENT POSTS

Nov 30, 2022

Nov 30, 2022

Mar 2, 2023

Mar 2, 2023

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open ...

March 16, 2023

Markets & Policy

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of PowerThe Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity. Stakehold...

November 9, 2022

Mercom Research Focus

India’s Solar Market Leaders for 1H 2022Mercom India has released its report, India Solar Market Leaderboard 1H 2022, unveiling solar market leaders in the first half (1H) of the calendar year (CY) 2022. The report covers market share and shipment rankings across the In...

November 9, 2022

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ PerformanceBattery energy storage technologies globally are transforming how companies utilize, control, and dispatch electricity and facilitating a smoother transition to clean energy. The Indian market is also realizing how battery storage...

November 9, 2022

Trending News

November 30, 2022

November 30, 2022

March 2, 2023

March 2, 2023

November 28, 2022

Tender & Auctions

PTC India’s EoI to Procure 1 GW of Hybrid Power Receives Overwhelming Response

November 3, 2022

Magazine

Grid

GreenCell Raises $40 Million Funding from ADB to Develop Electric Buses

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ Performance

November 7, 2022

Latest News

This is custom content that will be displayed at the video in case you want to give an overview, etc. Michael Ballard

November 30, 2022

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open...

March 16, 2023

The Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity....

November 9, 2022

Some test content that can be displayed somewhere maybe if needed? Not sure Michael Ballard

November 30, 2022

March 2, 2023

OUR FLAGSHIP EVENT, MERCOM INDIA RENEWABLES SUMMIT, APRIL 2023 Mercom India Renewables Summit 2023 (formerly Mercom India Solar Summit) brings together developers, manufacturers, investors, innovators, and other key decision...

November 28, 2022

PTC India’s expression of interest (EoI) to procure 500 MW of hybrid renewable energy (wind and solar) (Tranche-I), with a greenshoe option for an additional 500 MW, has received a strong response, according to Mercom sources....

November 9, 2022

Ballard Power Systems, a fuel cell and clean energy solutions provider, recorded a net loss of $42.88 million in the third quarter (Q3) of 2022, a year-over-year (YoY) increase of 39%. The revenue for the quarter was $21.34...

November 9, 2022

Solid Power, Inc., a U.S.-based developer of all-solid-state battery cells for electric vehicles (EVs), reported a net loss of $12.4 million for the third quarter (Q3) 2022, a 46% increase from the $8.45 million loss during the...

November 9, 2022

Get the most relevant India solar and clean energy news.

POPULAR POSTS

Test Video Post2

Nov 30, 2022

14:46 Installs a Record 2.5 GW of Solar Open Access in 2022, Up 92% YoY

Mar 16, 2023

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of Power

Nov 9, 2022

JANUARY 2023

Nov 30, 2022

DECEMBER 2022

Mar 2, 2023

NOVEMBER 2022

Mar 2, 2023

Mercom India Renewables Summit 2023

Nov 28, 2022