Global Energy Crisis May Expedite Transition to Sustainable and Clean Sources: IEA

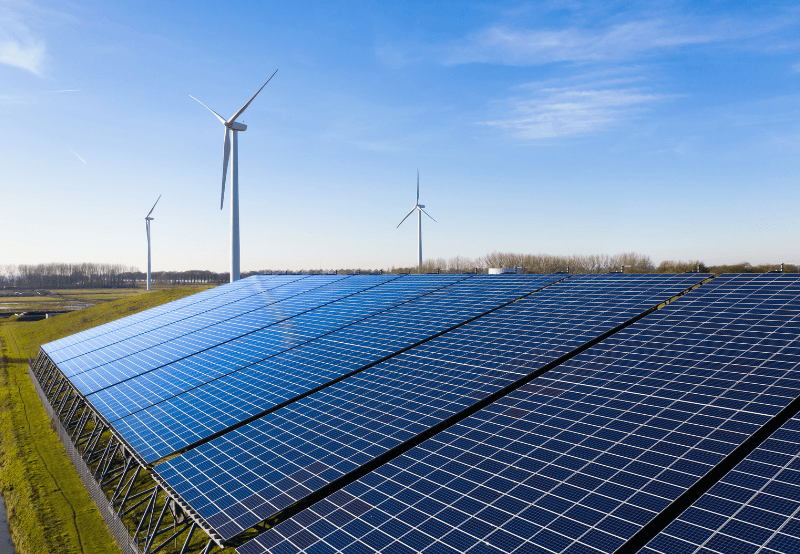

Investment in renewables needs to double to more than $4 trillion by 2030

October 28, 2022

The global crisis triggered by the war in Ukraine could ironically accelerate the transition to a more sustainable and secure energy system, according to the latest World Energy Outlook by the International Energy Agency (IEA).

The energy markets, at present, remain extremely vulnerable, with unrelenting geopolitical and economic concerns. This crisis, the IEA warns, is a reminder of the fragility and unsustainability of the global energy system.

Contrary to claims that climate policies and net zero commitments contributed to an increase in energy prices, IEA’s analysis found insufficient evidence to support the claim. In most affected regions, a higher share of renewables correlated with lower electricity prices and more efficient homes. The agency identified that the heaviest burden was falling on poorer households, where a larger share of income is spent on energy.

Governments are now taking longer-term steps in their attempt to shield consumers from the impacts of the crisis. Notable responses include the much talked about U.S. Inflation Reduction Act, which aims to reduce carbon emissions by about 40% by 2030, and the European Union’s ‘Fit for 55’ package, which makes the bloc’s target to reduce emissions by at least 55% by 2030 a legal obligation.

Other assertive programs include the REPowerEU, Japan’s Green Transformation (GX) program, Korea’s aim to increase the share of nuclear and renewables, and the ambitious clean energy targets in China and India.

“Energy markets and policies have changed as a result of Russia’s invasion of Ukraine, not just for the time being, but for decades to come,” said IEA Executive Director Fatih Birol. “Even with today’s policy settings, the energy world is shifting dramatically…Government responses around the world promise to make this a historic and definitive turning point towards a cleaner, more affordable, and more secure energy system.”

Need for Stronger Policies

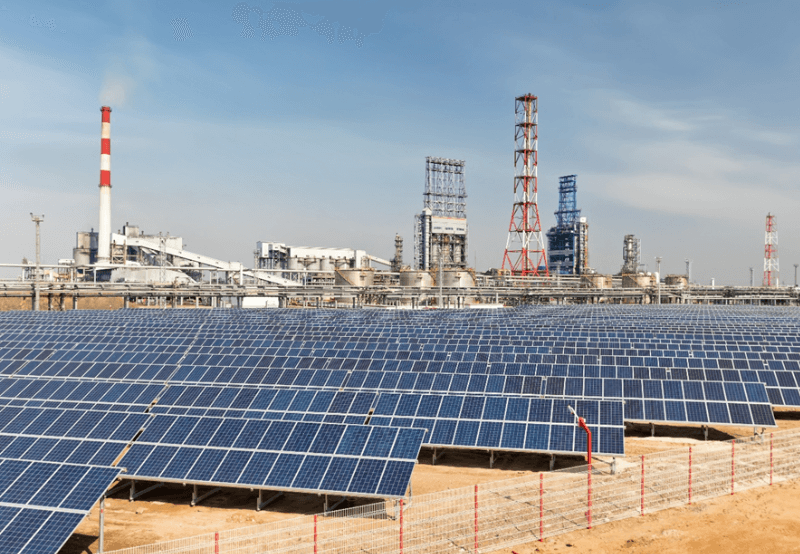

The IEA expects fossil fuel demand to peak or hit a plateau in all expected scenarios. The demand for coal from the present crisis is expected to be temporary as renewables, supported by nuclear power, see sustained gains. Based on current policies, natural gas demand will reach a plateau by the end of the decade, while oil demand will level off in the mid-2030s amid rising sales of electric vehicles.

Russian fossil fuel exports are not expected to return to pre-war levels. The country’s share of internationally traded energy can fall to 13% in 2030 from 20% in 2021 from the previous forecast, while the U.S. and the Middle East will gain market share.

The agency expects the share of fossil fuels in global energy to fall to just over 60% by 2050 from the current 80%. And carbon dioxide emissions globally are expected to fall back slowly to 32 billion tons by 2050 from a high point of 37 billion tons a year.

In its stated policies scenario, the agency expects clean energy investment to rise to slightly more than $2 trillion by 2030 – a rise of more than 50% from present numbers. Investment in renewable energy needs to double to more than $4 trillion by the end of the decade to meet net-zero emissions targets by 2050.

The report identified that stronger policies could be the key to driving an increase in energy investment needed to reduce the risks of future price increases and volatility.

“Major international efforts are still urgently required to narrow the worrying divide in clean energy investment levels between advanced and emerging and developing economies,” it said. “Full achievement of all climate pledges would move the world towards the safer ground, but there is still a large gap between today’s pledges and a stabilization of the rise in global temperatures around 1.5 °C.”

Fossil fuel combustion will grow by less than 1% in 2022 as the strong expansion of renewables and electric vehicles prevent a sharper rise, IEA said in another recent report. Emissions jumped by nearly two billion tons in 2021 as the world economy rebounded from the effects of the Covid pandemic.

According to IEA’s Renewable Energy Market Updates – Outlook for 2021 and 2022, renewable energy is expected to account for 90% of the global power capacity increase in 2021 and 2022.

Get the most relevant India solar and clean energy news.

RECENT POSTS

Nov 30, 2022

Nov 30, 2022

Mar 2, 2023

Mar 2, 2023

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open ...

March 16, 2023

Markets & Policy

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of PowerThe Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity. Stakehold...

November 9, 2022

Mercom Research Focus

India’s Solar Market Leaders for 1H 2022Mercom India has released its report, India Solar Market Leaderboard 1H 2022, unveiling solar market leaders in the first half (1H) of the calendar year (CY) 2022. The report covers market share and shipment rankings across the In...

November 9, 2022

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ PerformanceBattery energy storage technologies globally are transforming how companies utilize, control, and dispatch electricity and facilitating a smoother transition to clean energy. The Indian market is also realizing how battery storage...

November 9, 2022

Trending News

November 30, 2022

November 30, 2022

March 2, 2023

March 2, 2023

November 28, 2022

Tender & Auctions

PTC India’s EoI to Procure 1 GW of Hybrid Power Receives Overwhelming Response

November 3, 2022

Magazine

Grid

GreenCell Raises $40 Million Funding from ADB to Develop Electric Buses

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ Performance

November 7, 2022

Latest News

This is custom content that will be displayed at the video in case you want to give an overview, etc. Michael Ballard

November 30, 2022

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open...

March 16, 2023

The Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity....

November 9, 2022

Some test content that can be displayed somewhere maybe if needed? Not sure Michael Ballard

November 30, 2022

March 2, 2023

OUR FLAGSHIP EVENT, MERCOM INDIA RENEWABLES SUMMIT, APRIL 2023 Mercom India Renewables Summit 2023 (formerly Mercom India Solar Summit) brings together developers, manufacturers, investors, innovators, and other key decision...

November 28, 2022

PTC India’s expression of interest (EoI) to procure 500 MW of hybrid renewable energy (wind and solar) (Tranche-I), with a greenshoe option for an additional 500 MW, has received a strong response, according to Mercom sources....

November 9, 2022

Ballard Power Systems, a fuel cell and clean energy solutions provider, recorded a net loss of $42.88 million in the third quarter (Q3) of 2022, a year-over-year (YoY) increase of 39%. The revenue for the quarter was $21.34...

November 9, 2022

Solid Power, Inc., a U.S.-based developer of all-solid-state battery cells for electric vehicles (EVs), reported a net loss of $12.4 million for the third quarter (Q3) 2022, a 46% increase from the $8.45 million loss during the...

November 9, 2022

Get the most relevant India solar and clean energy news.

POPULAR POSTS

Test Video Post2

Nov 30, 2022

14:46 Installs a Record 2.5 GW of Solar Open Access in 2022, Up 92% YoY

Mar 16, 2023

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of Power

Nov 9, 2022

JANUARY 2023

Nov 30, 2022

DECEMBER 2022

Mar 2, 2023

NOVEMBER 2022

Mar 2, 2023

Mercom India Renewables Summit 2023

Nov 28, 2022