REC Limited’s Loan Disbursements to Renewable Energy Companies Rises by 426% in 1H FY 2023

The company disbursed a total of ₹83.34 billion for renewable energy companies during the period

October 28, 2022

REC Limited‘s consolidated net profit saw a marginal increase of 4% to ₹51.76 billion (~$628.57 million) in the first half (1H) of FY 2023, compared to ₹49.6 billion (~$602.34 million) in 1H FY 2022.

The company posted a total income of ₹194.17 billion (~$2.36 billion), a decrease of 1% compared to ₹196.14 billion (~$2.38 billion) during the same period last year.

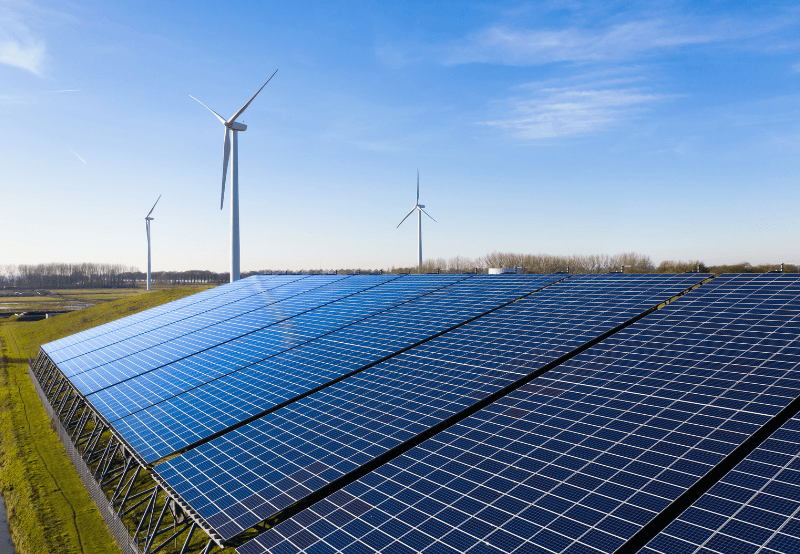

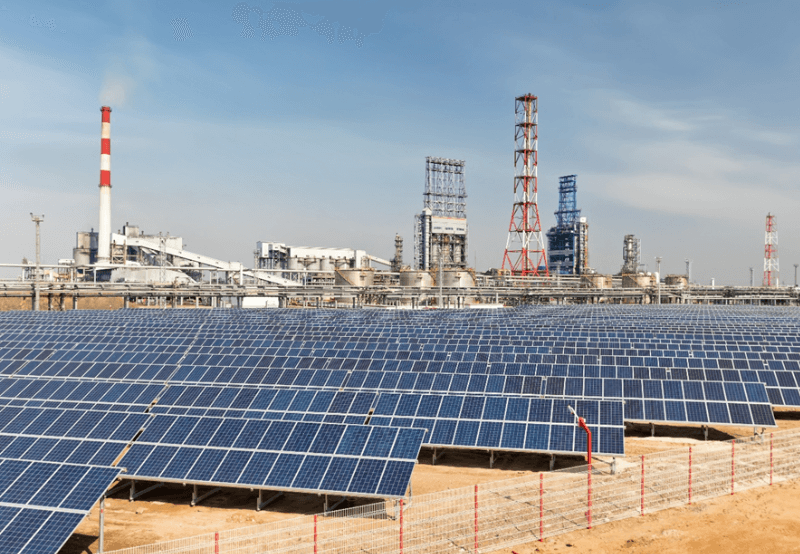

REC is an infrastructure finance company involved in financing power projects. The company also provides financial assistance to state power generators, state governments, state-owned and private power distribution companies, independent power producers, rural electric co-operatives, and private power generators.

The company’s loan book increased by 2% to ₹3.94 trillion (~$47.85 billion) as of September 30, 2022. The increase in loan book, coupled with sound asset resolutions, reduced net credit-impaired assets to 1.24% with a provision coverage ratio of 69.28% as of September 30, 2022.

Transmission and distribution companies accounted for ₹888.66 billion (~$10.79 billion) of the approved amounts in 1H 2023, an increase of 445% against ₹163.01 billion (~$1.97 billion) in the same period last year. Generation companies accounted ₹379.92 billion (~$4.61 billion), an increase of 361% compared to ₹82.46 billion (~$1.01 billion) during the same period last year. The approved loans for renewables stood at ₹105.63 billion (~$1.28 billion), an increase of 6.4% against ₹99.25 billion (~$1.21 billion) in 1H 2022.

REC disbursed ₹302.69 billion (~$3.67 billion) in 1H 2023 compared to ₹368.24 billion (~$4.47 billion) during the same period last year. Renewable energy companies received loan disbursements amounting to ₹83.34 billion (~$1.01 billion), a 426% YoY increase compared to ₹15.85 billion (~$192.48 million).

Distribution companies had the largest share of the disbursements with ₹119.18 billion (~$1.45 billion), a decrease of 35% compared to ₹184.15 billion (~$2.24 billion) in 1H FY 2022. In contrast, generation companies accounted for ₹63.93 billion (~$776.36 million), decreasing by 26% from ₹86.87 billion (~$1.05 billion) during the corresponding period last year.

Second Quarter (Q2) FY 2023

The company’s consolidated net profit increased by 11% in the second quarter (Q2) of FY 2023 to ₹27.32 billion (~$331.77 million) against ₹24.54 billion (~$298.01 million) during last year. The numbers marked an increase of 1.5% compared to ₹26.92 billion (~$326.91 million) during Q2 2022.

REC earned a total income of ₹99.64 billion (~$1.21 billion) during the quarter, up 5% against ₹95.06 billion (~$1.15 billion) in Q1 FY 2023. The numbers were down by 1% compared to ₹100.56 billion (~$1.22 billion) during the corresponding period last year.

Aided by a strong performance, the company’s net worth swelled to ₹534.57 billion (~$6.49 billion) at the end of September 2022, an increase of 2% quarter-over-quarter (QoQ).

Transmission and distribution companies accounted for ₹798.68 billion (~$9.69 billion) of the approved amounts, an increase of 1,059% compared to ₹68.99 billion (~$837.81 million) in Q2 2022. Generation companies accounted ₹23.3 billion (~$282.95 million), a decrease of 27% compared to ₹31.85 billion (~$386.78 million) during the same period last year. The approved loans for renewables stood at ₹6.78 billion (~$82.34 million), a YoY decrease of 91% against ₹71.14 billion (~$863.92 million).

The company disbursed a total of ₹178.27 billion (~$2.16 billion) during Q2 2023. Renewable energy companies received loan disbursements of ₹22.77 billion (~$276.52 million), a 328% YoY increase against ₹5.31 billion (~$64.48 million).

Distribution companies had the largest share of the disbursements with ₹184.85 billion (~$2.24 billion), a YoY growth of 25% compared to ₹147.42 billion (~$1.79 billion). Generation companies accounted for ₹44.86 billion (~$544.77 million), a 5% decrease from ₹47.3 billion (~$574.41 million) during the corresponding period last year.

Of late, the organization expanded its business offerings to fund infrastructure development projects such as metros. REC signed a loan agreement of ₹144.34 billion (~$1.75 billion) with the Mumbai Metropolitan Region Development Authority for nine metro projects being developed in the Mumbai metropolitan region.

The company reported a total income of ₹392.30 billion (~$5.05 billion) for FY 2022, an 11% YoY increase over ₹354.10 billion (~$4.56 billion).

In January this year, REC raised $1.175 billion (~₹82.45 billion) from a consortium of seven banks as the mandated lead arrangers and bookrunners. It was the single largest syndicated loan raised in the international bank loan market by any Indian non-banking financial company.

Get the most relevant India solar and clean energy news.

RECENT POSTS

Nov 30, 2022

Nov 30, 2022

Mar 2, 2023

Mar 2, 2023

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open ...

March 16, 2023

Markets & Policy

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of PowerThe Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity. Stakehold...

November 9, 2022

Mercom Research Focus

India’s Solar Market Leaders for 1H 2022Mercom India has released its report, India Solar Market Leaderboard 1H 2022, unveiling solar market leaders in the first half (1H) of the calendar year (CY) 2022. The report covers market share and shipment rankings across the In...

November 9, 2022

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ PerformanceBattery energy storage technologies globally are transforming how companies utilize, control, and dispatch electricity and facilitating a smoother transition to clean energy. The Indian market is also realizing how battery storage...

November 9, 2022

Trending News

November 30, 2022

November 30, 2022

March 2, 2023

March 2, 2023

November 28, 2022

Tender & Auctions

PTC India’s EoI to Procure 1 GW of Hybrid Power Receives Overwhelming Response

November 3, 2022

Magazine

Grid

GreenCell Raises $40 Million Funding from ADB to Develop Electric Buses

Energy Storage

Webinar to Shed Light on How Battery Storage Enhance Solar Systems’ Performance

November 7, 2022

Latest News

This is custom content that will be displayed at the video in case you want to give an overview, etc. Michael Ballard

November 30, 2022

India added 2.5 GW of solar open access in the calendar year (CY) 2022, a year-over-year (YoY) increase of 92% from the 1.3 GW installed in CY 2021, according to the newly released 2022 Q4 & Annual Mercom India Solar Open...

March 16, 2023

The Ministry of Power (MoP) has proposed that any coal-based thermal generation station coming up after April 1, 2024, must either install or procure renewable energy equivalent to 25% of the thermal generation capacity....

November 9, 2022

Some test content that can be displayed somewhere maybe if needed? Not sure Michael Ballard

November 30, 2022

March 2, 2023

OUR FLAGSHIP EVENT, MERCOM INDIA RENEWABLES SUMMIT, APRIL 2023 Mercom India Renewables Summit 2023 (formerly Mercom India Solar Summit) brings together developers, manufacturers, investors, innovators, and other key decision...

November 28, 2022

PTC India’s expression of interest (EoI) to procure 500 MW of hybrid renewable energy (wind and solar) (Tranche-I), with a greenshoe option for an additional 500 MW, has received a strong response, according to Mercom sources....

November 9, 2022

Ballard Power Systems, a fuel cell and clean energy solutions provider, recorded a net loss of $42.88 million in the third quarter (Q3) of 2022, a year-over-year (YoY) increase of 39%. The revenue for the quarter was $21.34...

November 9, 2022

Solid Power, Inc., a U.S.-based developer of all-solid-state battery cells for electric vehicles (EVs), reported a net loss of $12.4 million for the third quarter (Q3) 2022, a 46% increase from the $8.45 million loss during the...

November 9, 2022

Get the most relevant India solar and clean energy news.

POPULAR POSTS

Test Video Post2

Nov 30, 2022

14:46 Installs a Record 2.5 GW of Solar Open Access in 2022, Up 92% YoY

Mar 16, 2023

25% of Generation Capacity of Coal Plants Must be from Renewables: Ministry of Power

Nov 9, 2022

JANUARY 2023

Nov 30, 2022

DECEMBER 2022

Mar 2, 2023

NOVEMBER 2022

Mar 2, 2023

Mercom India Renewables Summit 2023

Nov 28, 2022